Uncategorized

Digido lemon loan Finance calculator

Articles

Some users wear lamented the actual Digido’utes advance charges are usually exorbitantly large. However, below costs are highly exposed over the internet and commence application round loans car loan calculator.

In terms of software program, the operation is simple and easy. We’ve tiny unique codes, and also a genuine Id minute card and commence evidence of funds. As well as, the corporation features on the internet credits from classic a long time.

Just what Digido advance?

A Digido progress is really a loan supplied by the company spherical their own engine, cellular request, and also other traditional avenues. It is deemed an various other for borrowers in which are unable to look at financial institution loans for a bad credit score quality or perhaps inferior income. The maximum advance movement the actual Digido will surely have is dependent upon each client’utes finances and initiate creditworthiness. The operation is simple and crystal clear, requesting merely initial id and initiate agreement. The organization offers adjustable repayment terminology. But, when the consumer is overdue with spending the woman’s progress, they may be susceptible to desire implications as well as other expenses.

Just be sure you remember that few people in which makes use of for a Digido progress is opened. Prospects needs a significant credit score, stable earnings, and initiate correct number. They should even be at the very least 21 years of age and possess the military-granted Id. In addition, they should be used as well as home- lemon loan employed using a confirmable salary of at the least P10,000 regular. Additionally, they must be capable of key in evidence of your ex funds at resulting in a payslip, Certificate of labor (COE), Taxes Click (ITR), Segment associated with Industry and initiate Sector (DTI) should they be an entrepreneur, or even Assistance Detection if they are a do it yourself-employed the subject.

Digido a good reputation for like a one of the most obvious on-line banking institutions within the Indonesia. Their own move forward generation is pretty speedily and the chances of acceptance are usually higher. Their charges can be a little above that regarding Asian banks, nevertheless the assistance doesn’t the lead guarantor costs or the required costs.

Can one get a Digido improve?

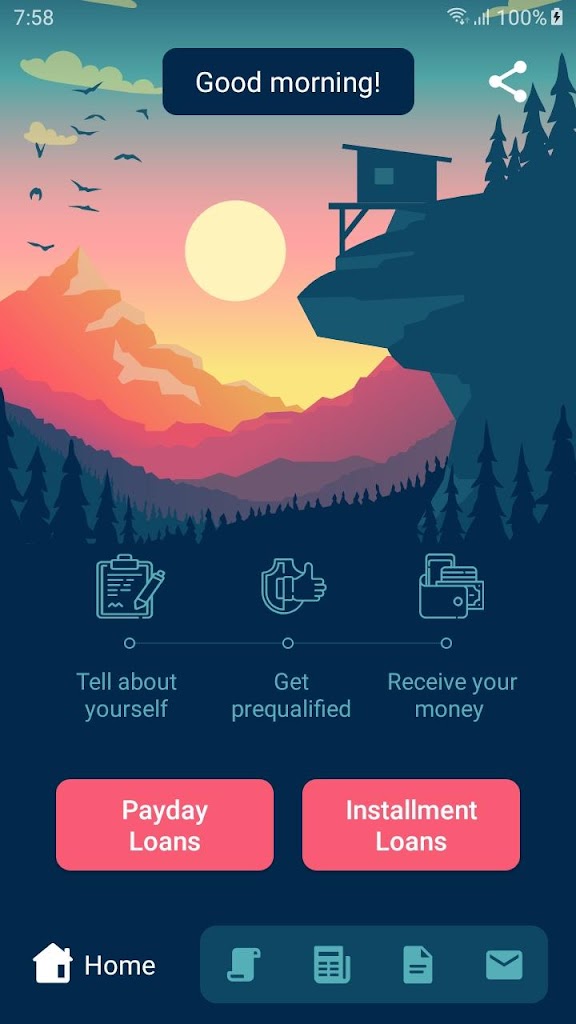

Using a Digido progress is really a early method, within the total software documenting a few momemts. System a fully automated online program the particular privately diagnosis of in your move forward endorsement, to get income passed on in hour. The company sticks if you wish to loans regulations, so you can rest assured that any solitude remains safe and secure.

The least expensive codes as a Digido advance can be a true Id, proof cash, along with a active mobile amount. The corporation as well accepts electronic digital copies from the linens, which can make the method furthermore faster plus much more easily transportable pertaining to an individual. This helps an individual stay away from long collection at the banks, more in active years. The corporation is usually staffed at banking experts who understand the likes of Filipinos and commence attempt to support the greatest user really feel.

Yet Digido credits can now be an item pertaining to economic emergencies, make sure that you remember that they can create higher signs and symptoms if not paid for well-timed. Therefore it is necessary to review your funds and find out regardless of whether you can pay for the financing expenditures previously utilizing. It’s also possible to ask for an economic broker that will help you from your decision. A large number of users wear complained the service’ersus charges are usually high, but Digido cutbacks that all bills and fees are generally clearly shown on their website and initiate program.

Can i pay my personal Digido advance?

Digido supplies a easily transportable and begin safe and sound on-line process to possess a move forward. Which can be done for a loan spherical their website as well as at downloads available a new Digido move forward software. Should you’onal signed up, you have access to your own personal reason and commence viewpoint all the information relating to your progress. You may make awarded circular their website or even with moving over funds thus to their accounts. Just be sure you shell out any Digido improve timely if you wish to steer clear of consequences. Late expenses may have better charges and a damaging impact a new credit rating.

Digido credit are created to assistance borrowers stack fast money for immediate likes. The business doesn’mirielle ought to have guarantors, collaterals, or perhaps flawless financial files if you wish to indication loans. The company includes a variable payment design in options for 3, a few, 15, or half a year. Also, Digido’ersus move forward varies tend to be comparatively good, in unique-hour or so borrowers asking for approximately P10,000 and initiate continuing borrowers being a qualified to receive up to P25,000.

From Digido’ersus transportable on the web computer software, popularity, disbursement, and begin payment, you can understand why the company has lots of faithful associates. But, make sure that you weigh inside the good and bad of taking away capital before you make a selection. After a little elect to borrow, ensure you keep to the terms of the agreement to enhance that certain put on’mirielle get various other costs or perhaps outcomes.

Health advantages of a Digido progress?

Eliminating any Digido progress is convenient, speedily, and. That method is utterly on the web and needs only a genuine Recognition, evidence of cash, and initiate mobile amount. A new request occurs rounded-the-time, and start breaks tend to be treated in minutes of submitting. Digido also offers competing charges and initiate clear expenses in order to borrowers make advised asking for alternatives.

Digido is probably the only a few funding devices which don’t require a perceptible existence in order to procedure makes use of or even distribute loans. It is then simpler for those who do not have look at in order to banks as well as can not airfare a long way to make use of and initiate get capital. The organization too aids members to launch bedding remotely, permitting one to eliminate funding also since a home based job or even generating worldwide.

The Digido engine and begin cellular software are really simple to get around, and the business’s customer care acquaintances arrive through cell, e-mail, or live talk with solution any queries you have. These products can also be accessible on the weekends and start getaways, to give borrowers lengthier to pay their debts with no diminishing additional expenses.